ACTIVE AND DEFERRED MEMBERS

YOUR BTPS MEMBER NEWSLETTER

Member visit: Paradise, Birmingham

BTPS online retirements

BT Digital Dictionary

And more...

YOUR BTPS MEMBER NEWSLETTER

Member visit: Paradise, Birmingham

BTPS online retirements

BT Digital Dictionary

And more...

The 2024 BTPS newsletter for members of the BT Pension Scheme.

I’m pleased to introduce this newsletter, my first as Chair of the BTPS Trustee Board. I joined in May last year and was appointed as Chair in November following the retirement of my predecessor, Otto Thoresen.

Earlier this year we said a fond farewell to Beryl Shepherd who, after serving as a BTPS Trustee for 15 years, has left us for a well-earned retirement. Beryl has been integral to the great strides that we have made in member services and will be much missed around the Trustee Board table. We will welcome a new trustee to fill Beryl’s role in due course.

During the year we have continued to focus on our core objectives; continually improving the service we provide to members, ensuring the deficit recovery plan remains on track and that the Scheme’s investment strategy stays resilient.

I’m pleased to say that despite high levels of volatility and uncertainty in the world at large, the Scheme’s deficit is reducing, funding levels have improved, and we remain on course to be fully funded by 2030.

Your feedback continues to play a vital role in the way we evolve our services. I was delighted to see in this year’s member survey, that overall satisfaction is now at record levels with continued improvement across all measures.

As part of our commitment to continuous innovation, earlier this year we launched our fully online retirement service. Members can now retire entirely online, without having to send identity documents in the post.

Finally, it was fantastic to spend time with members face to face when we visited one of the Scheme’s investments with strong sustainability credentials – the Birmingham Paradise re-development project. Read on to learn more.

Jill Mackenzie

Chair of the BTPS Trustee Board

MENU

Paradise

Forward thinking is at the heart of the BTPS investment strategy, ensuring we can continue to meet members’ benefit payments as they fall due.

This summer, a group of members had the chance to see one of the Scheme’s long-term UK developments when they joined us on a trip to Paradise, an urban development bringing new life to the heart of Birmingham city centre. Members also met BTPS Trustee Emily Clark and Trustee Chair Jill Mackenzie on the day.

The Paradise development is a major 15-year project to redevelop Paradise Circus from the old Birmingham central library to a thriving hub of events, workplaces, restaurants, and public spaces.

When completed in 2028, Paradise will deliver 10 brand new buildings combining office, retail, hotel and leisure spaces into Birmingham’s existing cityscape. Developer MEPC who lead the project told us that these buildings will provide 1.74 million sq ft of office space and 120,000 sq ft of retail and leisure space to keep the area attractive for local residents, visitors and workers alike1.

The development represents a £1.2 billion investment into the city. The site is currently in stage two of a three-stage development journey and is already the home of several major companies such as PWC, DLA Piper and Knights.

To date Paradise has added £88 million of social and economic value, with over £56 million added to the local supply chain and 2,000 new jobs for Birmingham through the construction phases2.

This is all while providing a 7.19% pa return for the scheme since its inception in 20163.

2 https://www.mepc.com/ | 3 https://www.mepc.com/ | 4 https://www.hermes-investment.com/uk/en/institutions

One of the eight members who joined us for this year’s visit was 79 year-old Christine Soares.

From the Black Country, Christine joined BT (or GPO Telephones as it was known then) on 4 September 1961 as a switchboard operator, aged just 16. She joined as part of a training cohort of 500 young women, a few of which she is still friends with after 63 years.

Joining BT for Christine involved her training for 6 weeks at Wing School Newhall Street, before moving on to full-time work at Telephone House. During her training she learnt how to handle a variety of different call types, from personal to emergency calls.

Christine left BT in 1964 to start her family but used the switchboard skills she’d gained at BT for the rest of her career, working at switchboards in hospitals, police stations and industry sites. Christine went back to GPO in 1978, and again in 1989, working at BT until 1996.

Speaking of the Scheme’s investment in Birmingham Paradise, she said

“It makes me proud of the city again”

Last October we invited Dr Paul Litchfield, former BT Chief Medical Officer and BTPS member, to our administration centre in Chesterfield, Derbyshire, to talk to the BTPS member services team.

As well as his session with BTPS employees, Dr Litchfield recorded a video for BTPS members looking to start their retirement. The video explores the importance of planning for the non-financial aspects of leaving work, as well as the monetary implications.

Dr Litchfield has held senior positions in the Royal Navy, the UK Civil Service and, for almost 20 years, was Chief Medical Officer at BT. He currently chairs the “What Works Centre for Wellbeing”, which is dedicated to understanding what can be done to improve wellbeing across society, as well as holding appointments with the Health & Safety Executive, NHS England and is independent medical adviser to ITV. He was awarded the OBE in 2007 and the CBE for his services to wellbeing in the workplace

Our online member portal continues to attract new users, with over 130,000 members having registered and over 1,200,000 quotes and calculations run. As well as running retirement quotes, you can update your contact details, ask us questions and check any ongoing activity. You can also tell us who you’d like to receive a pension or possible death benefit if you were to die.

This is especially important if you aren’t married or in a civil partnership but have a partner who is financially dependent on you. Just login and go to ‘My pension’ and ‘If I die’ to complete a nomination or expression of wish. If you haven’t already registered for the portal, it’s really easy. You’ll need your BTPS membership number, National Insurance number and a personal email address.

Earlier this year, we introduced fully online retirements, believed to be an industry first for a defined benefit scheme. Prior to this, members had to sign and post us their application form and ID documents in order to verify their identities. Now, the entire retirement process can be completed online.

96%

of all retirement quotes are being generated by members themselves

When we launched our new online portal for members in 2021, we included a pension calculator, giving members the ability to run their own retirement quotes. Now, 96% of all retirement quotes are being generated by members themselves, with over 350,000 being produced each year.

Previously, members could complete part of their retirement application online, but were still required to complete and physically sign a paper application and post this to us along with a copy of their photo ID.

On the BTPS portal, deferred members can run retirement quotes to decide on their chosen option, confirm their choice, complete the application, verify their identity digitally and submit their retirement application option online. We’ll keep you informed by email every step of the way.

To retire online, you’ll need a smart phone or tablet with a camera function as we’ll ask you to take and upload a photo of your passport or driving licence as well as a selfie, to prove your identity.

The online retirements technology first checks that the ID is genuine and not fraudulent, and then matches it to the user’s face.

“I was surprised at how quick

and easy the whole process

was and dates were met,

communication was

excellent.”

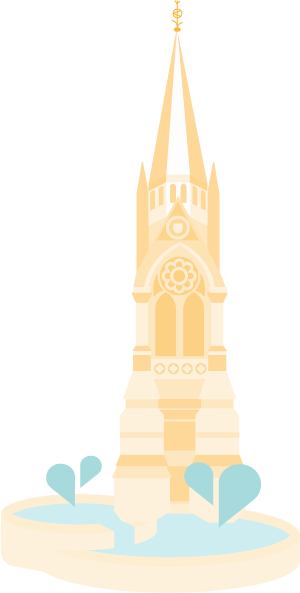

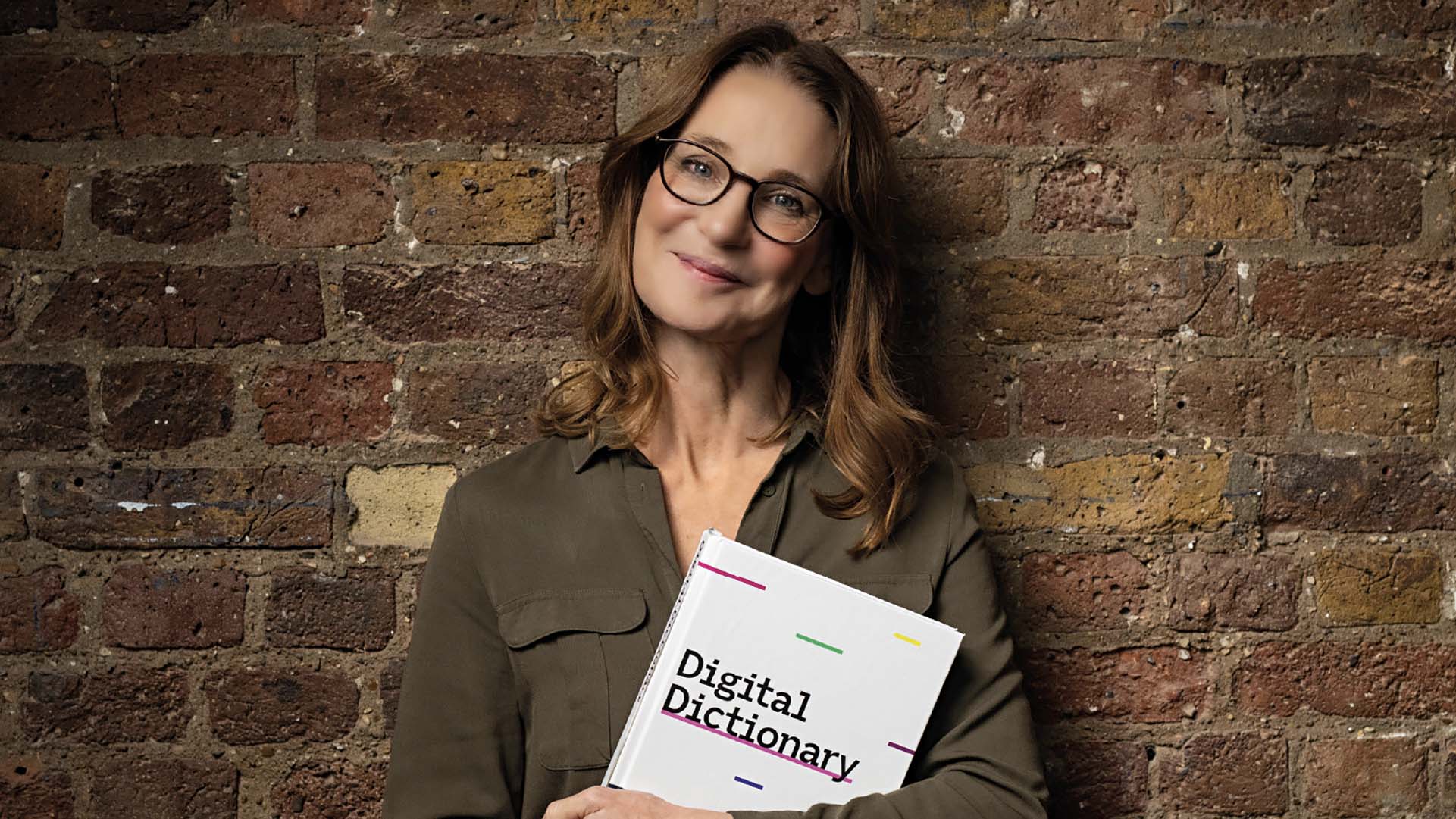

BT Group has teamed up with lexicographer and queen of Dictionary Corner, Susie Dent, to create a Digital Dictionary, in order to help older and digitally excluded people get a better understanding of online jargon.

New research conducted by BT group found that one in six older people admit to feeling “baffled” by digital terms, and 78% feel left behind by their lack of knowledge. In response, Susie Dent, BT Group and UK charity AbilityNet have partnered to create the Digital Dictionary, which identifies the most misunderstood words used on the internet and provides simple explanations.

Explore BT's Digital Dictionary

The Dictionary contains 21 words in total, including the likes of hyperlink (41% misunderstood), QR code (24%) and the cloud (23%). Lack of understanding around these common online terms creates a significant issue, with the survey of 2,000 older people finding that even though they spend five and a half hours a week online, over half (55%) wish that they were more knowledgeable when it comes to using the internet

38%

of older people said they experienced feelings of frustration when unable to understand digital terms, and in fact, over one in 10 respondents think online terms are so complicated that a foreign language would be easier to learn.

16%

Furthermore, 16% of people worry that others will see them as a ‘burden’ if they ask for help, especially as over one in ten (16%) admit that family members have got irritated when having to explain to them.

Lexicographer, Susie Dent said:

“Whilst so much of modern life seems easier online – whether that’s booking a doctor’s appointment, managing your finances, or doing the weekly shop – we’re forgetting one crucial thing: it’s only easier if you understand the language the web is built on.

So, I’ve teamed up with BT Group and AbilityNet to create this Digital Dictionary, a guide that simplifies the language of the internet, with the aim of helping us all make the most of life in an online world.”

Victoria Johnson, Social Impact Campaigns Director, BT Group said: “It’s a shame to see from the research that older adults feel they are a burden when asking for help navigating their way online. We want to create a more inclusive society by helping them make the most of life in the digital world.

We hope that both the Digital Dictionary and variety of online guides on offer will give people the confidence to start exploring the internet and give them all the training and support needed to live life to the fullest in the digital age.”

For the sixth year in a row, member satisfaction with the service we provide has increased.

Your feedback also is the main driver of our improvement campaigns. If you receive an email survey from us or are offered the chance to leave feedback after a phone call, please take the time to tell us what went well and what we can do better.

This year the Scheme was awarded Defined Benefit Pension Scheme of the Year at the Pensions Age Awards and at the UK Pensions Awards 2024. Both awards ceremonies highlight the outstanding achievements of the UK pensions industry, and key to both wins was your feedback, with the judges praising the scheme for its huge efforts to drive improvements in member satisfaction.

We hope you find this newsletter helpful and interesting. If you have any thoughts on topics you’d like featured in future or any feedback on this newsletter, please tell us your views on the BTPS annual newsletter by completing the short survey below.

Keep your contact details up to date so we can make sure you don’t miss out on important news about your pension. Register for our member portal and log in to manage your pension online.

Visit: btps.co.uk

Call: 0800 731 1919 (or +44 203 023 3420 from overseas) Lines open Mon to Fri, 8.30am to 5pm exc. Bank Holidays. If you have hearing or speech difficulties, downloading the Relay UK app to your smartphone can help. Find out more here: https://www.relayuk.bt.com/

Email*: member@btps.co.uk

Write*: BTPS, Sunderland, SR43 4AD

* Please include your name, date of birth and either your BTPS membership number or National Insurance number in any correspondence

This newsletter is for information purposes only. Your BTPS benefits are always subject to the BTPS Rules and relevant legislation. If there’s any difference between the description of benefits in this document and the BTPS Rules or legislation, the BTPS Rules and legislation will take precedence.

How we use your personal information:

BT Pension Scheme Administration Ltd, on behalf of the Trustee, will process personal data relating to you, and to any person whose personal data is provided in connection with potential benefits, in order to administer the Pension Scheme. For more information on how we process your personal data and what your individual rights are under the UK General Data Protection Regulation (‘UK GDPR’) and Data Protection Act 2018 (‘DPA 2018’), please read our latest Privacy Notice at btps.co.uk/PrivacyNotice or write to BTPS, Sunderland SR43 4AD.