Over the year we have maintained our focus on the Scheme’s core objectives: ensuring the funding plan remains on track; that the Scheme’s investment strategy stays resilient; and continually improving the service we provide to members.

I’m pleased to say that despite high levels of global economic uncertainty and market volatility, the Scheme still remains on course to be fully funded by 2030, with the funding deficit in line with projections. I’m pleased that the diligence and hard work which goes in to managing and scrutinising our investments in these challenging times is paying off.

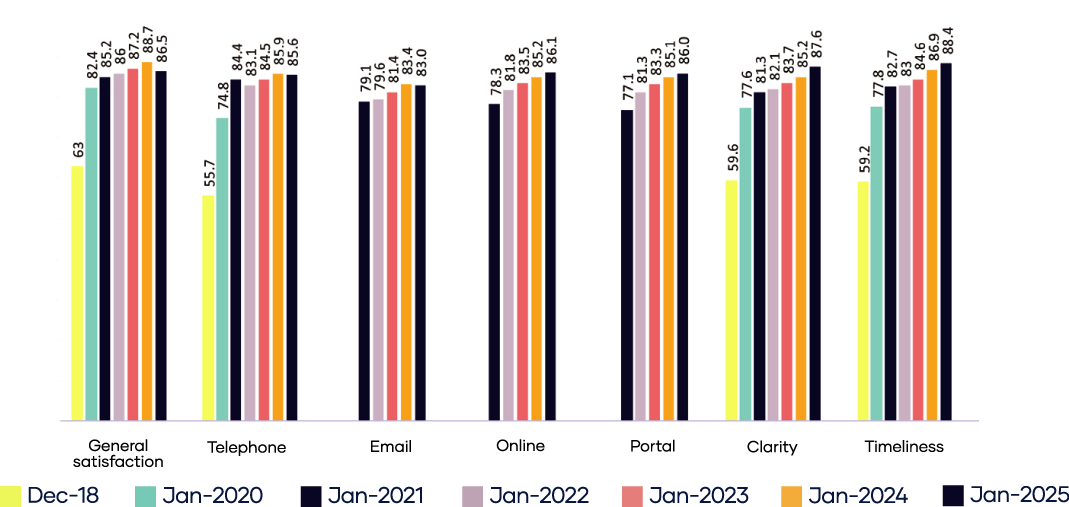

Your feedback continues to play a vital role in the way we evolve our services. I would like to extend my thanks to members who completed our first survey with the Institute of Customer Service (ICS). The results of this independent survey show our customer service as one of the highest rated in the UK. As a result, we’ve attained Service Mark, a national standard independently recognising organisations on their commitment to customer service. Our own internal survey shows that overall member satisfaction has remained high at 86.5%. When I visit our Member Service Centre in Chesterfield it pleases me to see the commitment of everyone to deliver their best for members.